Swing trading is popular among forex traders interested in short term trading strategies. A swing trader in the forex market will typically keep a position open for more than one day but less than one week. This distinguishes swing trading strategies from day trading strategies, since FX day traders typically want to close most positions before their trading day is over.

When you keep positions open for such a short period of time (less than a week), transacting costs becomes more important then when you make long-term investments in FX currency. It is very important to locate an FX trading site where your profits will not be swallowed whole by costs. FX trading sites that are popular among forex day traders tend to be popular among forex swing traders too.

When you keep positions open for such a short period of time (less than a week), transacting costs becomes more important then when you make long-term investments in FX currency. It is very important to locate an FX trading site where your profits will not be swallowed whole by costs. FX trading sites that are popular among forex day traders tend to be popular among forex swing traders too.

The key to successful swing trading is to identify an overall trend and use it to capture gains while it lasts, rather than to look for a break in the trend. Generally speaking, swing traders prefer to trade within the trend rather the contrary to the trend, even though it is possible to create a contrarian swing trading technique.

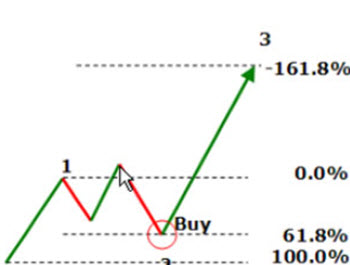

Technical analysis can be used to identify trends in the FX market. You can start by drawing trend lines for support and resistance for a currency pair, and work from there. You can for instance look for a pullback and buy currency when the uptrend resumes. When you determine that the upward trend is slowing or is about to stop, you sell. Of course, placing orders (and getting them filled) at the best moment is tricky, even for a seasoned FX trader.

This article was last updated on: August 7, 2016